As part of a special offer to consumers, refinancing may be made available. This is not a standard offer. If you are interested in offering Contract Refinancing, please contact your salesperson or uSupport to inquire.

Features of Refinancing

Our standard Refinancing option:

- UGA waives any Unpaid Fees and Interest from the Principal Balance to be refinanced and performs the refinance, resulting in a lower payment for the consumer.

- Consumer is required to enroll in AutoPay.

- Consumer must sign New Charge, AutoPay Form and Refinance Documents electronically.

Process

Eligible Contract

The Contract must be marked as eligible to be refinanced. When the portal sees the Contract is eligible, a special notice is shown on the home screen. The consumer will click to Learn More.

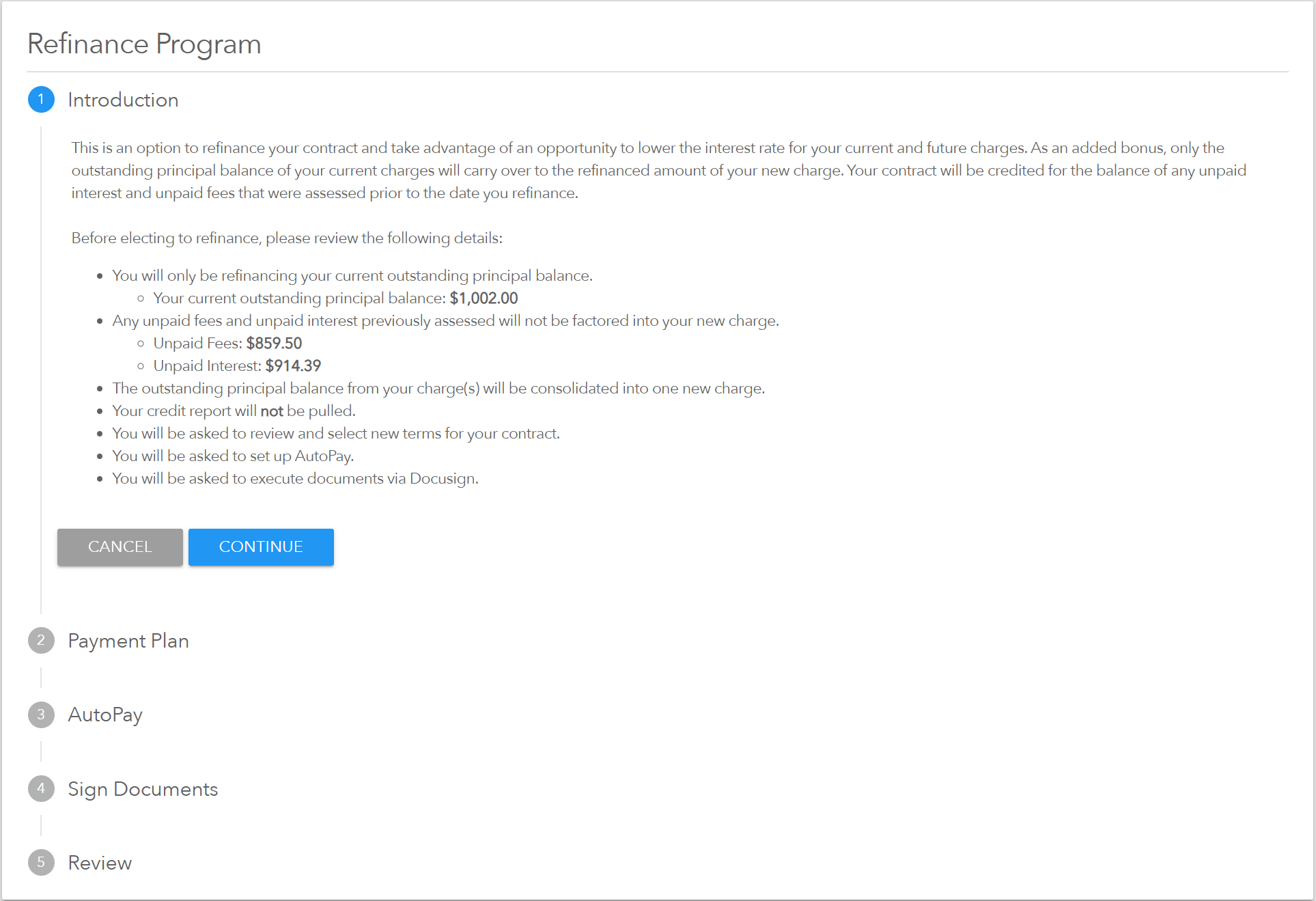

Overview

An overview of the refinance process is shown along with specific amounts that will be removed (Unpaid Interest and Unpaid Fees) and the Principal Balance that will be refinanced.

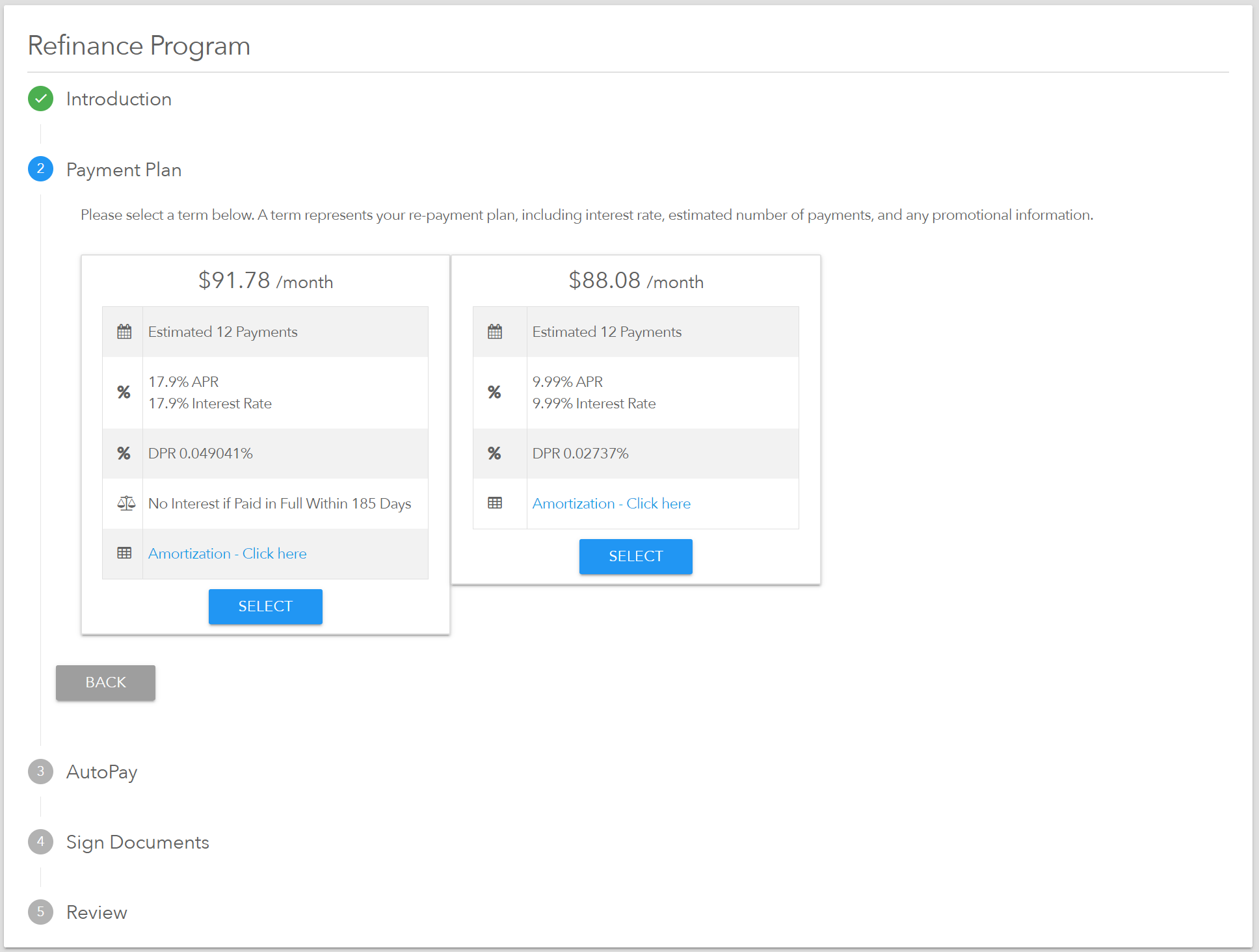

Select Payment Option / Term

Based on the Finance Program, one to many payment options will be displayed. APR and estimated number of payments will vary by program.

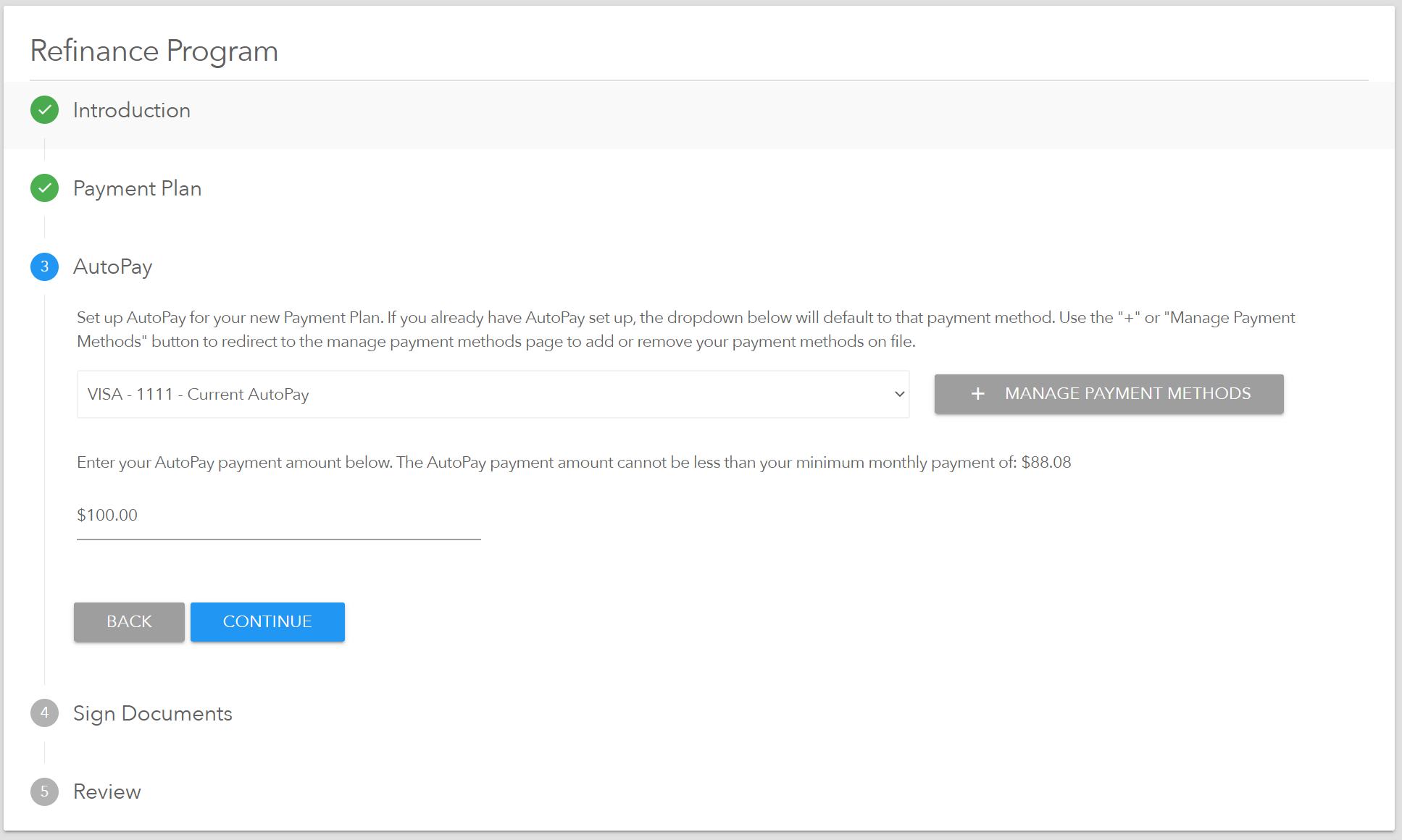

Enroll in AutoPay

Since a new payment amount will be defined and as AutoPay is required to refinance. The AutoPay enrollment screen will be presented to the consumer. Depending on the program, ACH or Credit/Debit Cards will be allowed.

NOTE - If a new payment method is needed, the user will be routed to payment method entry screens and will have to return to the refinance screen.

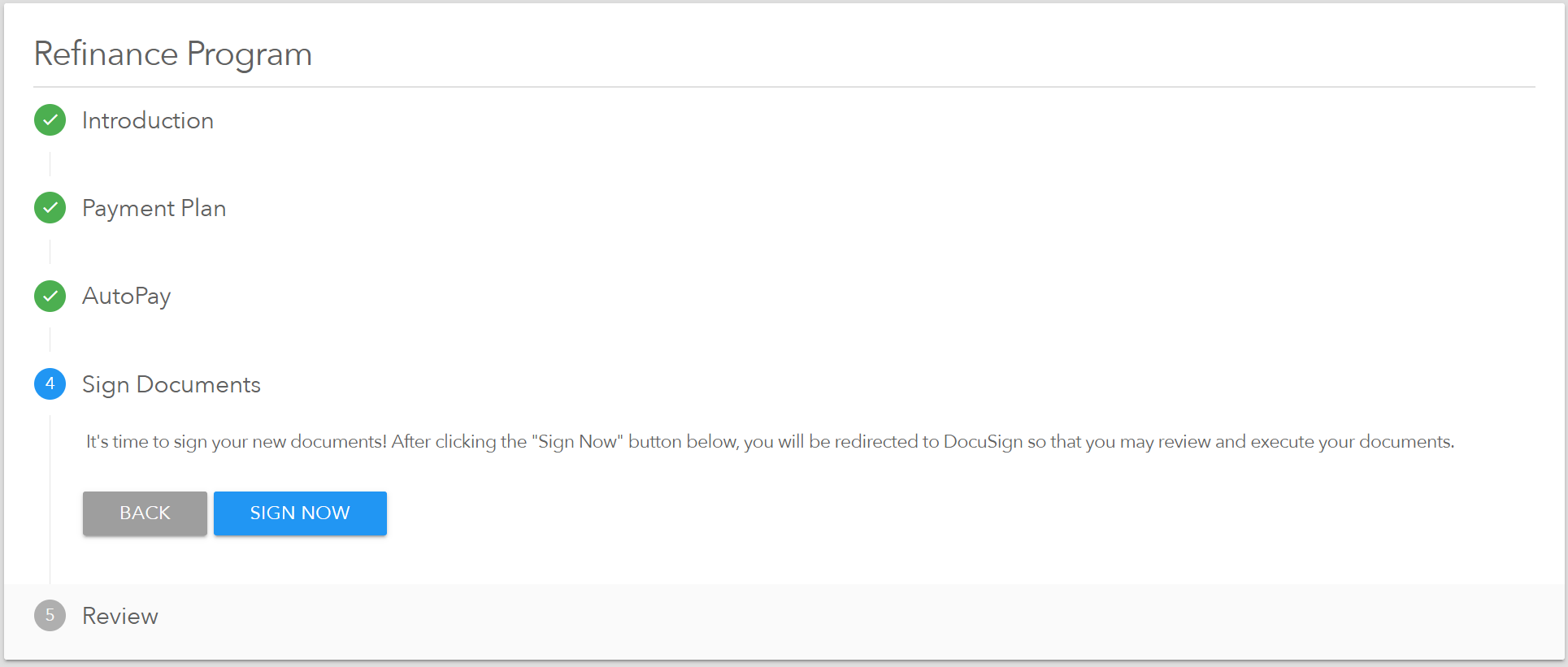

Sign Agreements

The final step is to sign the agreements. A Charge Slip, AutoPay Form, and Refinance Document are presented for electronic signature.