Reports in this set are designed to inform you about your delinquent accounts and their status.

Report Set Permission = Default (This report set can be assigned to Any user)

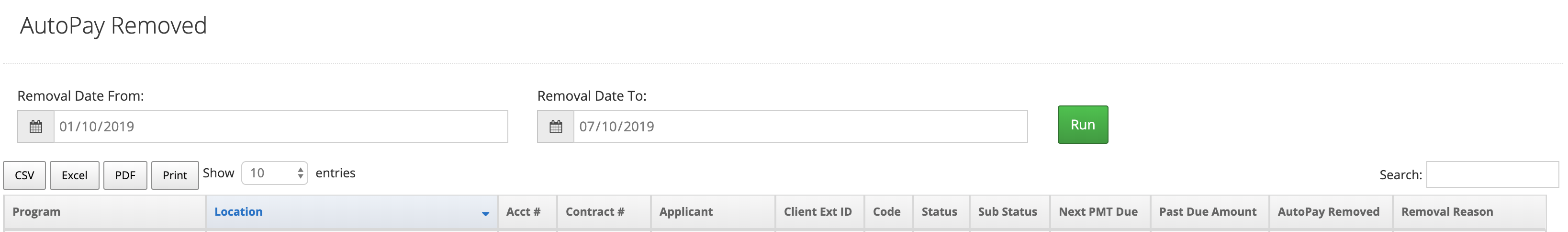

AutoPay Removed

This report will show you when AutoPay was removed from a contract and why it was removed.

Field Definitions

| Column Name | Definition | Example |

|---|---|---|

| Program | Name of your Program | Open-End Contracts |

| Location | Location where account was originated | Kansas City |

| Acct # | 7 Character Random Account Number uniquely assigned by our system. Accounts can contain multiple Contracts, Subscriptions and POS Transactions | ABC1234 |

| Contract # | Accounts can have multiple Contracts, the Contract number is build on the Account Number (ACCT#LOA##) | ABC1234LOA01 |

| Applicant | Name of the Primary Applicant / Account Holder | John Doe |

| Client Ext ID | Unique ID assigned by you and given to us during the origination process or via a data update. This is critical when linking data back to other systems like Accounting Software or Fulfillment/ERP systems | Student Number, Patient Number, Client Number as some examples and length and type can vary widely by client. |

| Code | Defines if the Contract is in Servicing (SRV) or has been Purchased (PUR) | SRV |

| Status | Status of the Contract (Pending, Active, Closed, Cancelled and VOID) | Active |

| Sub Status | Provides more detail about the Contract Status. Active: Current, Past Due, Write-Off Review Closed: Attorney Retained, Bankruptcy, Buyback, Canceled, Client Cancel, Contract Error, Deceased, Fraud, Paid, Refund, Refusal, Rewrite, Sent to Collection Agency, Skip, Small Balance Write-Off, Transfer Account, Write-Off) | Current |

| Next PMT Due | Due Date of Next Payment | 2018-01-05 |

| Past Due Amount | Amount the Contract is currently Past Due | $150.00 |

| AutoPay Removed | Date AutoPay was removed from this Contract | 12/03/2017 4:47 AM |

| Removal Reason | Reason AutoPay was removed - Varies from Decline Codes or Consumer Actions | 54: Declined (card expired) |

FAQs

How many attempts will be made before AutoPay is removed?

- By default, we will attempt AutoPay 3 times over a 15 to 20 day period. If there are three failed attempts, then AutoPay will be removed by our system.

- If a Checking or Savings Account is being used, and the Payment NSFs, then AutoPay will be removed.

- If using a Credit/Debit Card and we get a Decline Code like "Expired Card" or "Do Not Honor", the system will remove the Autopay at that time, even if we have not made 3 attempts. Certain decline reasons will never result in a successful payment, so when those decline codes are returned, we remove AutoPay.

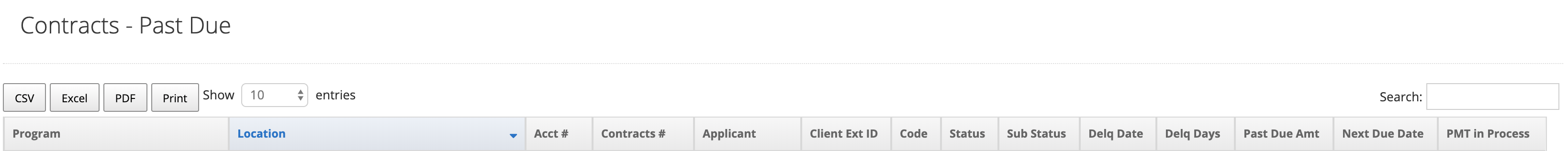

Contracts - Past Due

This report will show you all active Contracts that are currently Past Due and in SRV (servicing) portfolio.

Field Definitions

| Column Name | Definition | Example |

|---|---|---|

| Program | Name of your Program | Open-End Contracts |

| Location | Location where account was originated | Kansas City |

| Acct # | 7 Character Random Account Number uniquely assigned by our system. Accounts can contain multiple Contracts, Subscriptions and POS Transactions | ABC1234 |

| Contract # | Accounts can have multiple Contracts, the Contract number is build on the Account Number (ACCT#LOA##) | ABC1234LOA01 |

| Applicant | Name of the Primary Applicant / Account Holder | John Doe |

| Client Ext ID | Unique ID assigned by you and given to us during the origination process or via a data update. This is critical when linking data back to other systems like Accounting Software or Fulfillment/ERP systems | Student Number, Patient Number, Client Number as some examples and length and type can vary widely by client. |

| Code | Defines if the Contract is in Servicing (SRV) or has been Purchased (PUR) | SRV |

| Status | Status of the Contract (Pending, Active, Closed, Cancelled and VOID) | Active |

| Sub Status | Provides more detail about the Contract Status. Active: Current, Past Due, Write-Off Review Closed: Attorney Retained, Bankruptcy, Buyback, Canceled, Client Cancel, Contract Error, Deceased, Fraud, Paid, Refund, Refusal, Rewrite, Sent to Collection Agency, Skip, Small Balance Write-Off, Transfer Account, Write-Off) | Current |

| Delq Date | Delinquent Date the Account went Delinquent (Past Due). Empty if the account is Current. | 2017-09-01 |

| Delq Days | Delinquent Days the account has been Delinquent. | 60 |

| Past Due Amt | If Delinquent this is the amount Past Due that would need to be paid to make the Contract current. | 0.00 |

| Next Due Date | Date the next payment is due for this Contract. | 2017-11-01 |

| PMT IN PROCESS | Payment is made but won't settle until nightly process | 2017/11/11T02:45:02.000Z |

FAQs

Is this data Real Time or Live Data?

- Yes, the data on this report is pulled directly from our live system when it's ran. Information will change daily

My Customer made a payment today, But it's not reflected on this report, why?

- Payments made today will start in a processing status. We settle all payments after 9PM CST everyday. Once a payment is settled it will go into a complete status and completed payments are applied to the Interest, Principal and Fee balances on the Contract.

- If a payment is made after 3PM CST it may not settle the same day and will remain in processing until it settles the next day.

- You can open the customer's account in uPortal360 and click on Transactions. This will show you all payments including payments in processing status.

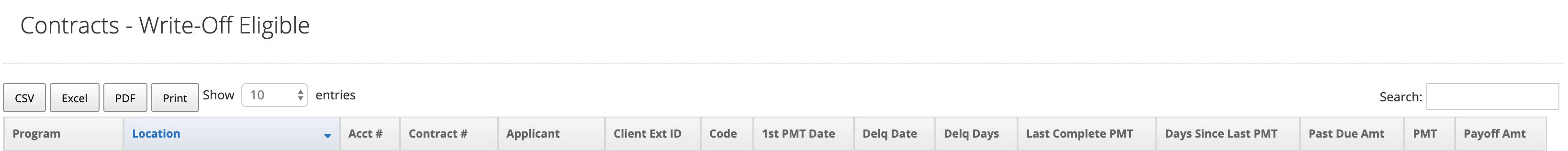

Contracts - Write-Off Eligible

This report will show you all active Contracts that are currently Past Due and meet the criteria for Write-Off. The Write-Off eligibility is based on the assumption of the days the Contract will be delinquent at the End of the Month if no payments are made.

Field Definitions

| Column Name | Definition | Example |

|---|---|---|

| Program | Name of your Program | Open-End Contracts |

| Location | Location where account was originated | Kansas City |

| Acct # | 7 Character Random Account Number uniquely assigned by our system. Accounts can contain multiple Contracts, Subscriptions and POS Transactions | ABC1234 |

| Contract # | Accounts can have multiple Contracts, the Contract number is build on the Account Number (ACCT#LOA##) | ABC1234LOA01 |

| Applicant | Name of the Primary Applicant / Account Holder | John Doe |

| Client Ext ID | Unique ID assigned by you and given to us during the origination process or via a data update. This is critical when linking data back to other systems like Accounting Software or Fulfillment/ERP systems | Student Number, Patient Number, Client Number as some examples and length and type can vary widely by client. |

| Code | Defines if the Contract is in Servicing (SRV) or has been Purchased (PUR) | SRV |

| 1st PMT Date | Date 1st Payment is Due. | 2017-06-01 |

| Delq Date | Delinquent Date the Account went Delinquent (Past Due). Empty if the account is Current. | 2017-09-01 |

| Delq Days | Delinquent Days the account has been Delinquent. | 60 |

| Last Complete PMT | Date of the Last Payment Made | 2017-09-01 |

| Days Since Last PMT | Number of Days since Last Payment was Made | 90 |

| Past Due Amt | If Delinquent this is the amount Past Due that would need to be paid to make the Contract current. | 250.00 |

| PMT | Monthly Payment Amount | 164.93 |

| Payoff Amt | Principal Bal + Interest Balance + Fees Balance = Payoff Amount - The amount currently owed to payoff this Contract. | 6896.00 |

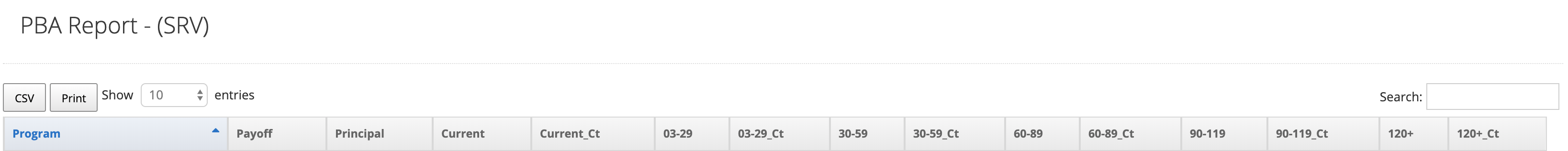

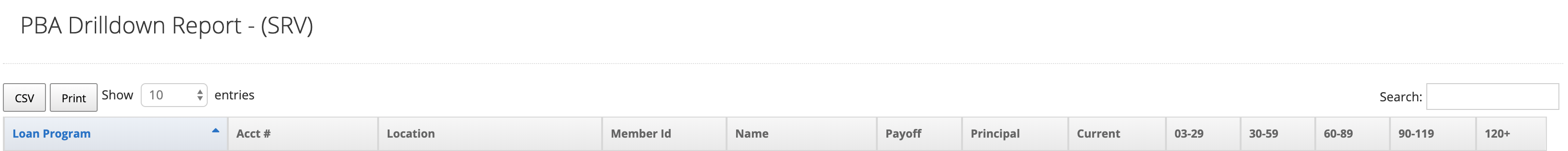

Principal Balance Aging (PBA)

e

PBA is a report that summarizes all accounts into buckets by Principal Balance. The report can be used to see the amount of dollars at risk if a bucket continues to be delinquent to a point of write-off. E.g. if you have $5,000 in 120+ it's likely that $5,000 will be written off within the next 30 days.

This report has "drill down" features. Your data is summarized on the report, then you can click on the hyperlink values (the Count Ct Fields) to see a display of the contracts that make up these counts.

Field Definitions

PBA

| Column Name | Definition | Example |

|---|---|---|

| Program | Name of your Program | Open-End Contracts |

| Payoff | Total Payoff Balance of ALL Contracts | $120,000.00 |

| Principal | Total Principal Balance of ALL Contracts | $90,000.00 |

| Current | Total Principal Balance of Contracts in a Current Status | $110,000.00 |

| Current_Ct | Count of Current Contracts | 17 |

| 03-29 | Total Principal Balance of Contracts 3 to 29 Days Delinquent | $4,000.00 |

| 03-29_Ct | Count of Contracts that are 3 to 29 Days Delinquent | 4 |

| 30-59 | Total Principal Balance of Contracts 30 to 59 Days Delinquent | $3,000.00 |

| 30-59_Ct | Count of Contracts that are 30 to 59 Days Delinquent | 3 |

| 60-89 | Total Principal Balance of Contracts 60 to 89 Days Delinquent | $2,000.00 |

| 60-89_Ct | Count of Contracts that are 60 to 89 Days Delinquent | 2 |

| 90-119 | Total Principal Balance of Contracts 90 to 119 Days Delinquent | $1,000.00 |

| 90-119_Ct | Count of Contracts that are 90 to 119 Days Delinquent | 1 |

| 120+ | Total Principal Balance of Contracts over 120 Days Delinquent | $0.00 |

| 120+_Ct | Count of Contracts that are over 120 Days Delinquent | 0 |

PBA Drilldown

| Column Name | Definition | Example |

|---|---|---|

| Program | Name of your Program | Open-End Contracts |

| Acct # | 7 Character Random Account Number uniquely assigned by our system. Accounts can contain multiple Contracts, Subscriptions and POS Transactions | ABC1234 |

| Location | Location where account was originated | Kansas City |

| Name | Name of the Primary Applicant / Account Holder | John Doe |

| Payoff | Total Payoff Balance of ALL Contracts | $120,000.00 |

| Principal | Total Principal Balance of ALL Contracts | $90,000.00 |

| Current | Total Principal Balance of Contracts in a Current Status | $110,000.00 |

| 03-29 | Total Principal Balance of Contracts 3 to 29 Days Delinquent | $4,000.00 |

| 30-59 | Total Principal Balance of Contracts 30 to 59 Days Delinquent | $3,000.00 |

| 60-89 | Total Principal Balance of Contracts 60 to 89 Days Delinquent | $2,000.00 |

| 90-119 | Total Principal Balance of Contracts 90 to 119 Days Delinquent | $1,000.00 |

| 120+ | Total Principal Balance of Contracts over 120 Days Delinquent | $0.00 |

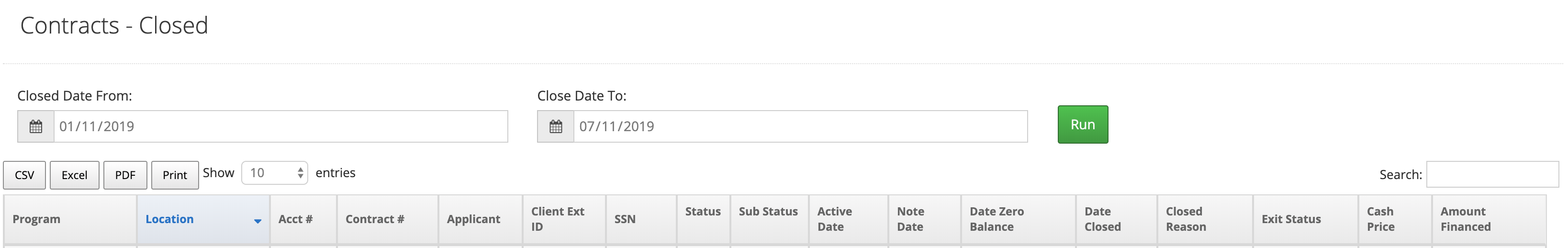

Contracts - Closed

| Column Name | Definition | Example |

|---|---|---|

| Program | Name of your Program | Open-End Contracts |

| Location | Location where account was originated | Kansas City |

| Acct # | 7 Character Random Account Number uniquely assigned by our system. Accounts can contain multiple Contracts, Subscriptions and POS Transactions | ABC1234 |

| Contract # | Accounts can have multiple Contracts, the Contract number is build on the Account Number (ACCT#LOA##) | ABC1234LOA01 |

| Applicant | Name of the Primary Applicant / Account Holder | John Doe |

| Client Ext ID | Unique ID assigned by you and given to us during the origination process or via a data update. This is critical when linking data back to other systems like Accounting Software or Fulfillment/ERP systems | Student Number, Patient Number, Client Number as some examples and length and type can vary widely by client. |

| SSN | Last 4 of applicant's social listed on report | xxx-xx-0000 |

| Status | Status of the Contract (Pending, Active, Closed, Cancelled and VOID) | Active |

| Sub Status | Provides more detail about the Contract Status. Active: Current, Past Due, Write-Off Review Closed: Attorney Retained, Bankruptcy, Buyback, Canceled, Client Cancel, Contract Error, Deceased, Fraud, Paid, Refund, Refusal, Rewrite, Sent to Collection Agency, Skip, Small Balance Write-Off, Transfer Account, Write-Off) | Current |

| Active Date | Date the Contract was Activated in our System and we started to service the account - Create statements, accrue interest, etc. | 2017-10-11 |

| Note Date | Date the Contract was written to take effect and Day Interest would start to Accrue and Assess. | 2017-10-11 |

| Date Zero Balance | Date the account went to a $0.00 balance | 2018-12-20 |

| Date Closed | Date the account was closed by the contract owner | 2018-07-10 |

| Closed Reason | Reason for account being closed | Refusal |

| Exit Status | Used to indicate what happened to contracts that were closed but not paid | Send to Collections |

| Cash Price | Retail amount of the Items(s) purchased | 5500.00 |

| Amount Financed | Retail Price less Cash Price is the Amount Financed. | 4500.00 |