Credit Applications may have issues when they are processed. This can be related to the Application Data or a potential underwriting issue. Most of these items can be resolved by the consumer.

Application Data Validation

Credit Freeze

The consumer has placed a Freeze with a Credit Reporting Agency (TransUnion, Experian, Equifax), preventing the Credit Inquiry.

Resolution:

Consumers must remove the freeze they set with the Credit Reporting Agency.

No Hit

A No Hit is returned if a Credit Report cannot be found.

Resolution:

Check the Application and make sure all information is accurate, and try again.

Specifically, add Full Social Security Number if not previously provided

Optionally provide previous Last Name or Address

PEND (Pending Applications)

A consumer credit application may be set to Pending (PEND) if there is a concern about Fraud or KYC (Know Your Customer) identification requirements. Some PENDs can be resolved by the consumer with Knowledge-Based Authentication (KBA) tools or by correcting mismatched data. In other situations, documentary details will have to be sent to UAS to validate and confirm that the PEND can be removed.

We will only PEND applications that meet the finance program’s criteria for approval.

Identity Verification

As part of the Consumer Identification Program (CIP), we may leverage a vendor that will validate the application data matches to the consumer’s identification. If the CIP vendor does not return a code representing a high-quality match, the application will be set to a Pending Reason of Identity Verification.

Resolution:

Successfully Answer KBA Questions

Share Documentary Details

Fraud Indicator

Consumers or some services have placed a Fraud Indicator on the Credit Report. This indicator requests that the consumer validate that they have authorized the inquiry.

Resolution:

The verified Phone Number matches the phone number provided in the Fraud Indicator

Consumer Enters the Matching Number

Consumer completes KBAs

SSN Mismatch

The SSN provided on the Credit Application does not match the Credit Report.

Resolution:

Re-enter the full SSN to match the credit report

DOB Mismatch

Date of Birth provided on the Credit Application does not match the Credit Report.

Resolution:

Enter a matching Birthdate

Contact the Credit Reporting Agency to confirm they have the proper Birthdate

Unresolved Data Mismatch

The consumer could not resolve the issue with self-service options and must contact UAS directly to provide documentary details to clear the PEND.

Resolution:

Call UAS and provide documentary details (Driver’s License, Passport, etc)

Self-Service PEND Resolutions

Credit Freeze

The screen will show the consumer the phone number and website of the Credit Reporting Agency where the freeze has been set.

.png) | .png) | .png) |

|---|

No Hit

The consumer will be asked to verify their Birthdate and enter their Full SSN. Additionally, if the consumer has recently changed their Last Name or Address, they can enter a previous value. We will use those previous values to find the proper credit report while keeping the original values with the application. This means we will keep what is likely the most updated information and use the previous data to find the proper Credit Report.

.png) | .png) | .png) | .png) |

|---|

Fraud Indicator

|

| Failed Number Match |

|---|---|---|

When the application is in Pending Fraud, the consumer needs to confirm they are applying for credit. | The last four digits of the phone number from the credit report fraud alert will be displayed as a hint, and the consumer should enter the phone number to resolve the PEND. | |

.png) | .png) | .png) |

KBA Questions

Samples of the KBA Questions

.png) | .png) | .png) |

SSN Mismatch

Confirm Social Security Number

.png)

DOB Mismatch

Confirm Birth Date

.png)

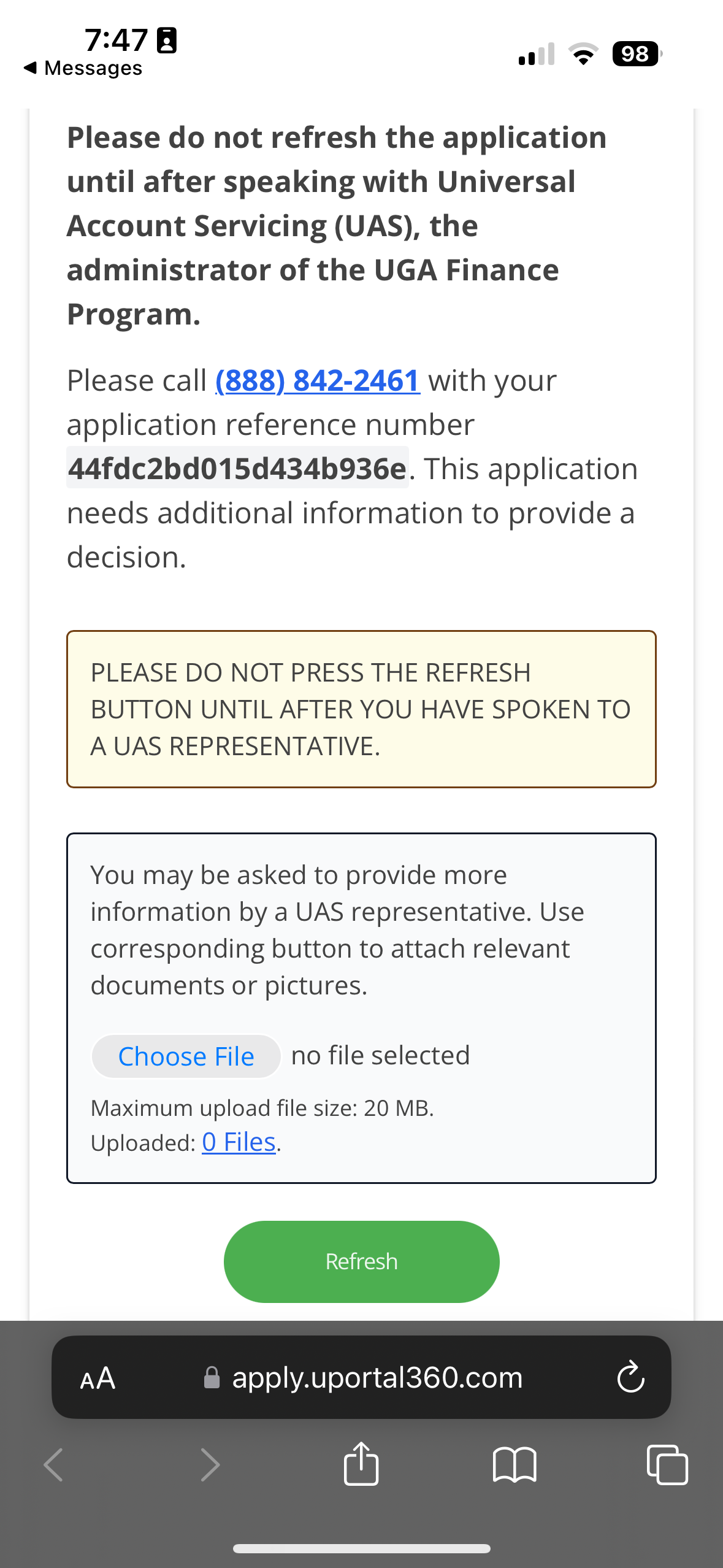

Unresolved Data Mismatch

Consumers will be prompted to call UAS.

Note: UAS has internal processes to resolve the application

.png) |  |  |

Expiration

Applications not passing data validation will expire 30 days after the initial application date. If a PEND is unresolved in 30 days, the application will be set to Pending Expired.

API Responses

Credit Freeze

{

"data": {

"id": "76697079907c4f3dae32",

"accountNumber": "2BBC85F",

"status": "CREDIT_FREEZE",

"edit": {

"href": "http://localhost:8081/applications/76697079907c4f3dae32",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/76697079907c4f3dae32",

"method": "GET"

}

}

}

No Hit

{

"data": {

"id": "d56761e04407407caf21",

"accountNumber": "WFB22A8",

"status": "NO_HIT",

"edit": {

"href": "http://localhost:8081/applications/d56761e04407407caf21",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/d56761e04407407caf21",

"method": "GET"

}

}

}Identity Verification

On PATCH, if Identity Verification is the pending reason, the following response is returned.

{

"data": {

"id": "35d7c30ef9d548fea349",

"accountNumber": "D4ACC4X",

"status": "PENDING",

"pendingReason": "IDENTITY_VERIFICATION",

"edit": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "GET"

}

}

}Fraud Indicator

{

"data": {

"id": "35d7c30ef9d548fea349",

"accountNumber": "D4ACC4X",

"status": "PENDING",

"pendingReason": "FRAUD",

"edit": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "GET"

}

}

}SSN Mismatch

{

"data": {

"id": "35d7c30ef9d548fea349",

"accountNumber": "D4ACC4X",

"status": "PENDING",

"pendingReason": "SSN_MISMATCH",

"edit": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "GET"

}

}

}

DOB Mismatch

{

"data": {

"id": "35d7c30ef9d548fea349",

"accountNumber": "D4ACC4X",

"status": "PENDING",

"pendingReason": "DOB_MISMATCH",

"edit": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/35d7c30ef9d548fea349",

"method": "GET"

}

}

}

Unresolved Data Mismatch

{

"data": {

"id": "45d7c30ef9d848fge389",

"accountNumber": "D4ACC4Y",

"status": "PENDING",

"pendingReason": "UNRESOLVED_DATA_MISMATCH",

"edit": {

"href": "http://localhost:8081/applications/45d7c30ef9d848fge389",

"method": "PATCH"

},

"self": {

"href": "http://localhost:8081/applications/45d7c30ef9d848fge389",

"method": "GET"

}

}

}